2024 Beef market outlook

Patrick Linnell, CattleFaX, January 2024 (Data & opinions were created by cattlefax for the beef checkoff for education purposes)

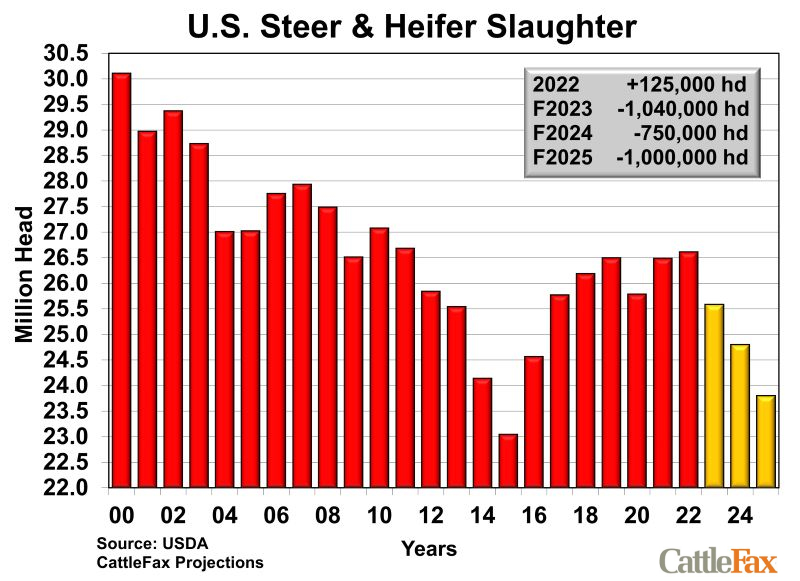

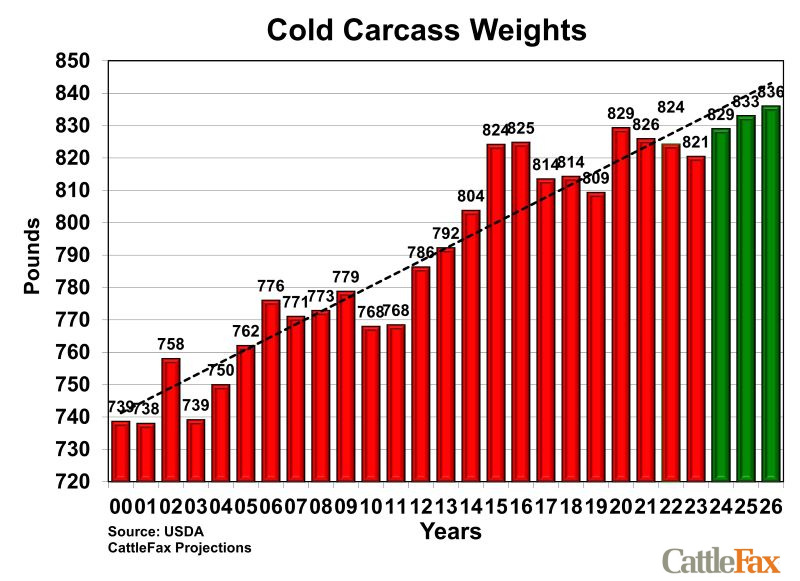

The reduction in cattle and beef supplies in 2024 is likely to come unevenly across the year, with supplies relatively more adequate early and tighter later. In terms of fed cattle supplies, the year begins with feedyard inventories above year-ago levels.² However, those inventories are likely to be spread out over the first half of the year. Feedyards are expected to slow the marketing pace as low costs of gain compared to selling prices encourage added weight, compounded by historically wide quality grade spreads in the boxed beef complex. Moreover, narrower packing margins will provide less incentive for the packing segment to aggressively procure cattle, slowing throughput and capacity utilization.

- CattleFax. Long Term Outlook. December 2023

- United States Department of Agriculture, Agricultural Marketing Service (USDA AMS). Actual Slaughter Under Federal Inspection. Various reports.

- CattleFax. Long Term Outlook. December 2023.

- CattleFax. CattleFax Update. Various report dates.

- United States Department of Agriculture, National Agricultural Statistics Service (USDA NASS). Livestock Slaughter Annual Summary. April 19, 2023.

- United States Department of Agriculture, National Agricultural Statistics Service (USDA NASS). Livestock Slaughter. Various report dates.

- United States Department of Agriculture, Agricultural Marketing Service (USDA AMS). Actual Slaughter Under Federal Inspection. Various report dates

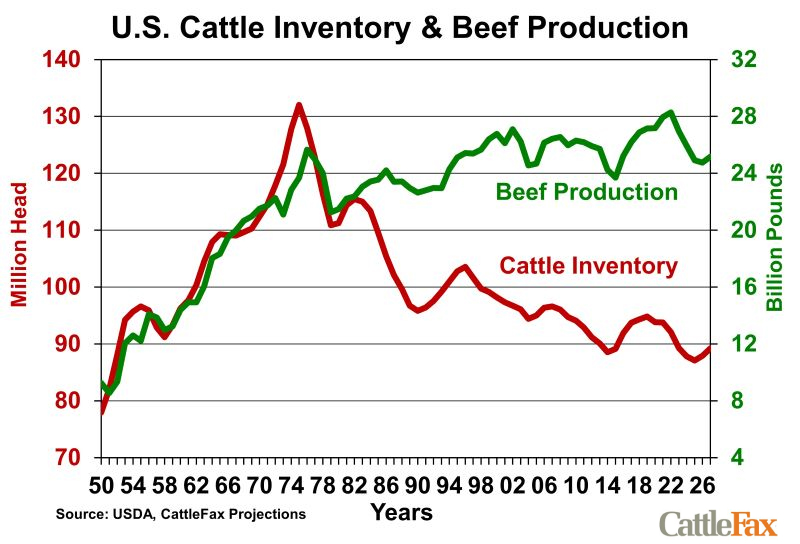

Fed cattle supplies should further tighten into the second half of the year, albeit much more of that story remains unwritten. Improved grazing prospects and simply fewer feeder cattle and calves to begin the New Year favors reduced placements in early 2024, driving larger year-over-year drops in the fed slaughter pace in the second half of the year. Cow and bull slaughter is also expected to tighten in 2024. Beef cow slaughter will decline as improved pasture conditions and profitability at the cow-calf level incentivize female retention, coupled with the fact that previous liquidation has simply reduced the number of cows throughout the country. Dairy cow slaughter is also likely to decline on improved margins in that sector. On the demand side of the equation, challenges persist but the U.S. economy and consumer remained remarkably resilient. While beef demand is measurably softer than recent highs, demand remains historically strong despite economic headwinds and more available competing protein supplies, as the consumer continues to value the quality and versatility of beef.

- CattleFax. Long Term Outlook. December 2023

- CattleFax. CattleFax Update. Various report dates.

- United States Department of Agriculture, National Agricultural Statistics Service (USDA NASS). Livestock Slaughter Annual Summary. April 19, 2023.

- United States Department of Agriculture, National Agricultural Statistics Service (USDA NASS). Livestock Slaughter. Various report dates.

- United States Department of Agriculture, Agricultural Marketing Service (USDA AMS). Actual Slaughter Under Federal Inspection. Various report dates.

What does this outlook mean to the beef complex? In general, most items can be expected to find relatively seasonal price patterns but with a higher bias throughout the year as supplies progressively tighten. Lean grind values will be supported by the reduction in non-fed slaughter, while 50’s may be somewhat more restrained by heavier carcass weights. When seasonally in demand, middle meat values may be especially supported by reduced piece counts but may also find more resistance at other times of the year due to higher price points and a price sensitive consumer. Meanwhile, end meats have the potential to be relatively more stable but again with a higher bias. Overall supplies will be tighter in 2024 but will be moderated by somewhat softer demand. As a result, expect prices in 2024 to be less volatile and increases to be less dramatic than the last several years.

Sources:

¹CattleFax. Long Term Outlook. December 2023. https://www.cattlefax.com/#!/news-landing/long-term/long-term-outlook---winter-2023

²CattleFax. CattleFax Update. Various report dates. https://www.cattlefax.com/#!/listing-page/update

³United States Department of Agriculture, National Agricultural Statistics Service (USDA NASS). Livestock Slaughter Annual Summary. April 19, 2023. https://downloads.usda.library.cornell.edu/usda-esmis/files/r207tp32d/8p58qs65g/g445dv089/lsan0423.pdf

⁴United States Department of Agriculture, National Agricultural Statistics Service (USDA NASS). Livestock Slaughter. Various report dates. https://usda.library.cornell.edu/concern/publications/rx913p88g ⁵United States Department of Agriculture, Agricultural Marketing Service (USDA AMS). Actual Slaughter Under Federal Inspection. Various report dates. https://www.ams.usda.gov/mnreports/ams_3658.pdf